- This event has passed.

Settlement House Program Call-In Day

Please mark your calendars for March 4, where we will be hosting a call-in day in support of the Settlement House Program before the Senate and Assembly each release their one-house budget proposals.

We will share a script soon, plus a social media toolkit. Additionally, UNH staff will be in Albany that day to reinforce our message. We have room for a small delegation to join us; if you are interested, please let Tara know at tklein@unhny.org.

Working Families Tax Credit Advocacy

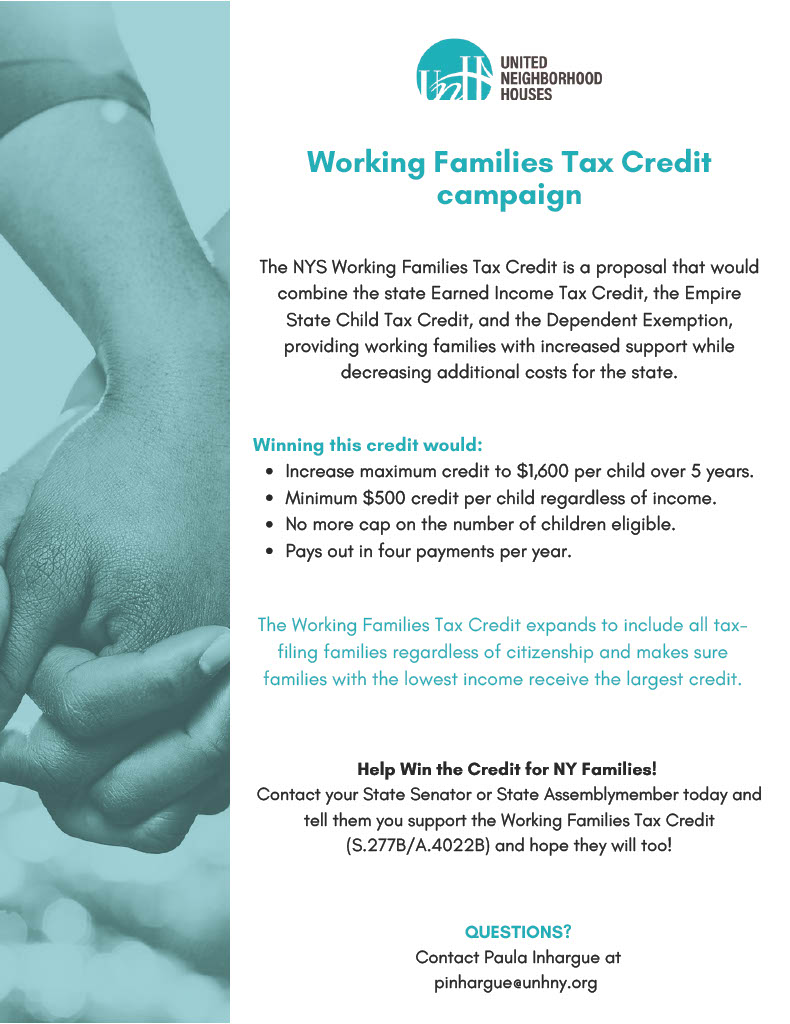

UNH is part of a campaign to create a Working Families Tax Credit, which would combine the Empire State Child Credit, Earned Income Tax Credit, and the dependent exemption into a new tax credit that also increases the value for families.

Support for this campaign has come from the research with Educational Alliance that many settlement houses participated in to study the impacts of the expanded federal Child Tax Credit.

Our most recent report details that families are still struggling without the expanded CTC, and New York State can lead on this issue to alleviate child poverty absent action from Washington The Working Families Tax Credit is a standalone bill, S.277A (Gounardes)/A.4022B (Hevesi), but ideally it will be included in the FY24-25 NYS Budget given its fiscal implications.

We want to spread the word about this potential reform and also share an FYI about the recent expansion of the Empire State Child Credit.

Attached to this email you can find a one pager on both of these:

- An informational flyer on the expanded Empire State Child Credit, which for the first time is available to families with children under age 4, and

- A flyer on the Working Families Tax Credit advocacy campaign with a call to action to support the campaign.

We hope you will consider putting these flyers out in your settlement house, especially if you are doing tax prep events this tax season. There is also a calculator that individuals can fill out to see what their current refunds are, versus what they would be under the WFTC.

The campaign is also hosting a lobby day in Albany on February 27, if you are interested in joining.